Insurance default

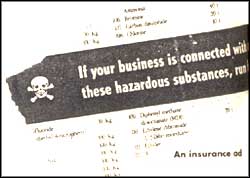

THE PROMULGATION of the Public Liability Insurance Act (PLI) -- to ensure that victims of chemical accidents get quick compensation -- is brewing into a controversy with public sector enterprises reluctant to take out policies under the new scheme. Under this law, insurance cover of a maximum of Rs five crore per accident or Rs 15 crore in a year has to be taken by all companies dealing with toxic, explosive, reactive or inflammable substances. A defaulter faces a penalty of six years' imprisonment or a fine of Rs one lakh, or both.

THE PROMULGATION of the Public Liability Insurance Act (PLI) -- to ensure that victims of chemical accidents get quick compensation -- is brewing into a controversy with public sector enterprises reluctant to take out policies under the new scheme. Under this law, insurance cover of a maximum of Rs five crore per accident or Rs 15 crore in a year has to be taken by all companies dealing with toxic, explosive, reactive or inflammable substances. A defaulter faces a penalty of six years' imprisonment or a fine of Rs one lakh, or both.

While over 1100 private industries have reportedly taken out policies, public sector companies are taking cover behind an exemption clause which calls for them to otherwise create a quick-compensation fund. But not one public sector company has taken a policy or constituted the fund.

Meanwhile, the government has introduced a bill to establish a national environment tribunal to decide cases related to industrial accidents. The bill affirms the principle of "strict civil liability." Any potentially dangerous industry would have to ensure safety to the people living nearby. The three-member tribunal will hear cases arising out of the PLI act. But with the public sector as yet left out, these well-intentioned moves may just not be enough.

Related Content

- Strategy for increasing green cover outside recorded forest areas: expert committee report

- Not a silver bullet: why the focus on insurance to address loss and damage is a distraction from real solutions

- Key indicators of situation of agricultural households in India (January – December 2013)

- Social Protection Index: Assessing Results for Asia and the Pacific

- Health covers may cost 20% more

- India Will not Cap Oil Imports from Iran