MALAR miracle

Confidence has many faces. In Ambedkar Colony in Kanyakumari district, women have secured a pukka road, electricity, water and a cremation ground. Pushpa, the panchayat president, says her task has just begun. "I want to build an overhead tank, a library, get bus facility to my village,' she says determinedly.

Confidence has many faces. In Ambedkar Colony in Kanyakumari district, women have secured a pukka road, electricity, water and a cremation ground. Pushpa, the panchayat president, says her task has just begun. "I want to build an overhead tank, a library, get bus facility to my village,' she says determinedly.

The change came with the Mahalir Association for Literacy Awareness (malar), begun in 1995 in Kanyakumari district. It started as a single self-help group (shg); today, it is a federation of 1,410 shgs with 28,000 women members. "We cover virtually all villages of Kanyakumari,' asserts Shelin Mary, president, malar. Adds Johnsily, the secretary, "Before, women would hesitate to even come out of the house. Today, they have no hesitation.'

Ironically, it was the abruptly terminated arivoli iyakkam (literacy movement) of the Tamil Nadu state government in 1994 which led to malar. When that four-year old movement wound up citing lack of funds, it left thousands of beneficiaries and volunteers stranded. A group affiliated to the Tamil Nadu Science Forum (tnsf), the implementing agency for the literacy movement, then decided to start differently.

"We thought of creating a savings structure which would earn some money for utilisation in literacy and other empowerment campaigns,' recalls malar activist Franco. The first shg started in Kiliyoor block. Conditions for membership included mandatory attendance at weekly meetings and compulsory savings of Rs 20 per month. Both conditions evoked reluctance initially. "We told them, unless you have a regular meeting, you won't be able to discuss, you will only be able to transact your money, that won't help,' says Franco. The women also felt Rs 20 per month was a big sum. "It is these same women who have collectively managed to build savings of Rs 3.65 crore, with Rs 9 crore in rotation as loans,' says Shelin Mary with pride.

Each shg collectively pays Rs 50 per month to the federation as a reserve fund; they are repaid after five years with 12 per cent interest per annum. On savings within groups, members get 12 per cent interest; for loans they are charged 24 per cent. A portion of this interest is allotted to the federation, and for the village coordinator's salary (who looks after 5-6 shgs and can earn up to Rs 1,000 as incentive per month). A member starts by taking loans from within the shg. After six months she can apply to the federation. Loans are given, based on the member's need.

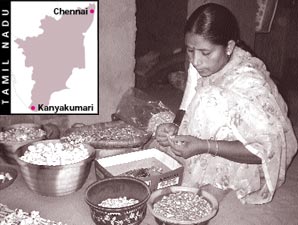

Initially, funds were utilised to pay off loans and redeem ration cards. Then emerged activities like vegetable vending, fish vending, petty shops, pottery, handloom, masala- and pickle-making and poultry. The women of Siluvai Nagar fishing village in the heart of Kanyakumari town, for instance, started making products out of shells. Says Rosemary of Siluvai Nagar, "We buy shells in bulk and make garlands, curtains, lampshades, especially during the tourist season.' She makes a profit of Rs 7,000 during these 3 months.

The banding together also meant that their village got street lights and they are now exploring ways to acquire pattas for their lands. Pushpa, too, became panchayat president with the help of group members. "They printed the notices and made the deposit on my behalf', she says. In other villages women spearhead anti-arrack, and cleanliness, drives. " malar is able to support 40 full-timers and 300 part-time village coordinators with the income generated,' explains Franco.

Other unique feature this federation offers are a death relief fund and pension plan. In the former, a one-time collection of Rs 50 is made. If a person dies within age 50, the family gets Rs 5,000; if later, Rs 2,500. But this scheme didn't take off. So the federation came up with the pension plan: each member can save Rs 25-100 every month for 10, 15 or 20 years. Afterwards, they can opt for a monthly pension or a lumpsum return. Two thousand women have now joined the pension fund.

After stringent checks, malar received a Rs 15 lakh loan from the Small Industries Development Bank of India (sidbi). Now sidbi has extended another loan of Rs 15 lakh. The Rashtriya Mahila Kosh has also promised Rs 35 lakh. "Our motive is economic advancement, health and literacy,' says Shelin Mary. And this is precisely the path malar is confidently striding ahead on.