THE MONEY MAKERS

US drug companies are responding to criticism of the high cost of prescription medicines by putting out a new message for consumers: "We are not out to fleece you. We are, in fact, toiling hard to

US drug companies are responding to criticism of the high cost of prescription medicines by putting out a new message for consumers: "We are not out to fleece you. We are, in fact, toiling hard to

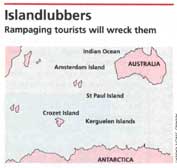

A nonchalant French government plans to throw open its virgin islands to tourists and game hunters

Some examples

An Indo US biodiversity research project contract has stirred up a hornet's nest

A new report accuses Big Tobacco of sabotaging WHO's efforts to fight smoking

Waste can fuel savings in cement plants

THE NEW FORESTERS . Sushil Saigal, Hema Arora and SS Rizvi . March . 2002 The new role of private enterprise in the Indian forestry sector, that's essentially what this book talks about. In the

But many believe closing over 7,000 coalmines would be futile

Industrial sectors, states scrap over mining bonanzas The mining and steel industries are at loggerheads over iron ore deposits. The steel industry has demanded exclusive use. It fears exports

DEBT WAIVER The loan waiver will benefit about 30 million small and marginal farmers. In an apparent move to appease the huge rural vote bank, the government today announced the biggest-ever agricultural loan waiver package that will cost the exchequer a whopping Rs 60,000 crore. The move will benefit about 30 million small and marginal farmers, whose debts worth Rs 50,000 crore will be completely waived, and about 10 million other farmers. Under this package, while all the outstanding unpaid loans of small and marginal farmers will be totally waived, the other farmers will have to repay only 75 per cent of the borrowed amount under one-time settlement arrangement. Announcing the largesse in his budget speech, Finance Minister P Chidambaram said the agricultural loans, which were restructured or rescheduled in 2004 and 2006, would also be eligible for loan waiver and concessional repayment through one-time settlement arrangement. All agricultural loans disbursed by the scheduled commercial banks, regional rural banks and cooperative credit institutions up to March 31, 2007, and overdue as on December 31, 2007, but not repaid till today, would be covered under this debt waiver-cum-relief scheme. The tillers of up to one hectare of land would be considered marginal farmers and those having one to two hectares of land would be deemed small farmers. The finance minister announced that the implementation of the scheme would be completed by June 30, 2008. The farmers would become entitled for fresh agricultural loans from the banks after the debt waiver or signing an agreement for repayment of 75 per cent amount under the one-time settlement arrangement. He, however, did not elaborate on how the banks would be compensated for the waived loans. Referring to the indebtedness of the farmers, Chidambaram pointed out that the government had appointed a committee under the chairmanship of R Radhakarishna to examine all aspect of this issue. "The committee had made a number of recommendations but stopped short of recommending waiver of agricultural loans.' The finance minister, however, sought to justify this populist move, maintaining that the government was conscious of the dimensions of the problem and was sensitive to the difficulties of the farming community. He also asserted that the government had carefully weighed the pros and cons of debt waiver and had also taken into account the resource position while taking this decision. Chidambaram told Parliament that notwithstanding some shortcomings, the growth of agricultural credit had been impressive. "We will exceed the target set for 2007-08. For 2008-09, I propose to set a target of Rs 2,80,000 crore.' he said. He thanked the commercial banks and regional rural banks which, together, accounted for between 75 and 79 per cent of agricultural credit disbursed during the year. Chidambaram said short-term crop loans would continue to be disbursed at an annual interest rate of 7 per cent, adding that an initial provision of Rs 1,600 crore had been made for interest subvention in 2008-09.

Mar 1 February, which is generally a lean month for car manufacturers as prospective buyers tend to postpone their purchase in anticipation of excise duty cuts in the Budget, saw market leader Maruti Suzuki India Ltd (MSIL) register flat sales in the domestic market at 59,311 units as compared to 59,095 units in February last year. Two-wheelers continued their year-long trend of decline in sales with major Companies witnessing a single digit negative growth. Analysts however, predict that sales will revive with a reduction in excise duty, both on smaller cars and two-wheelers, from 16% to 12% and simultaneous reduction in prices by various manufacturers with effect from March 1. While leading car manufacturers like MSIL, Hyundai Motor India Ltd, Tata Motors and General Motors reduced prices between Rs 7,000 and Rs 20,000 depending on the models, two-wheeler major Hero Honda, TVS Motor and Honda Motorcycle and Scooter India Ltd have also announced reduction in prices by Rs 1,000 to Rs 2,500. During February 2008, General Motor India witnessed a growth of 80% at 5,563 units as against 3,087 units during the same period last year. Sales of premium car manufacturer Honda Siel Cars India (HSCI) also grew 7.2% to 3,774 units during this period as compared to 3,521 units in February last year. Even Skoda India witnessed a growth of 102% at 1,303 units as against 644 units in February 2007. This is in contrast to the two-wheeler industry that has once again failed to recover from the woes of high interest rate and liquidity crunch. Sales of Hero Honda declined 5.37% to 2,65,431 units in February 2008 as compared to 2,80,515 units during the same month last year and that of Bajaj Auto dipped by 8.4% to 1,59,508 units as against 1,74,220 units in February 2007. The entry-level 100 cc segment has been badly hit after high delinquency forced major banks to withdraw finance availability in certain clusters across the country. According to industry estimates, the segment witnessed a decline of about 13%, which had offset stable sales in the 125 cc segment and above, resulting in an overall dip of 10% in the motorcycle industry. No wonder, players are now shifting focus to executive and premium bikes as the segment is comparatively less price sensitive and is giving higher margins to all manufacturers.

Union finance minister's Rs 60,000-crore loan waiver in the Union Budget proposals has won kudos for the government and has to some extent queered the pitch for the Opposition on this score. But a lot more needs to be done if the Congress-led UPA government has to regain the confidence of farmers. Bank loan is just one minor part of the problem and concerns only those farmers who take loans from banks. There are millions of farmers who take loans from moneylenders and commission agents at usurious prices. Maybe the government could issue an ordinance to stop payment on these loans, because in most cases the interest amount is more than double the actual loan. Even in the case of the farmers whose loans with banks have been waived, fresh trouble will begin next season. The crux of the problem which any farmer from Hoshiarpur to Wardha or Warangal will tell you, is remunerative price. Unless he gets remunerative prices, he will be in debt to the banks again. And what about corruption? A farmer from Hoshiarpur, for instance, if he wants to buy a tractor which costs say Rs 5-6 lakhs, has to pledge his four acres of land in addition to the ten per cent interest he pays on the loan. When he pledges his land he has to deal with the patwari and senior revenue officials. He has to bribe them to get his work done. Then he has to look for a middleman and pay him to negotiate to get his loan from the bank and finally at the bank he has to grease the palms of officials sanctioning the loans. On Rs 4 lakhs he pays over Rs 4,000 as bribe, and this is the minimum. The other important issue is cost of production. The government gives the farmer what it calls his cost of production. Perhaps the bureaucrats use their own parameters to arrive at the cost of production, but the farmer needs to survive. The businessman, for instance, adds his profits and perks to the cost of the items he produces. Shouldn't the farmer get a reasonable profit? He and his family work 24 hours, seven days a week, 365 days a year on their farm. In Maharashtra, farmers wait all night for power to run his pumps. And yet his cost of production does not take all this into account. This bias against the farmer must be removed.

A large part of identifying the beneficiaries, crucial for the success of the Rs 60,000-crore loan waiver to farmers, will be entrusted to banks. It is felt that this would be the best option for the government as banks are expected to have records of persons they have given loans to, and in the case of farmers, would also have the size of their holdings. Having set 2 hectares or 5 acres as the size of holdings for the waiver's beneficiaries, the government has the mammoth task of getting accurate lists ready so as to facilitate a complete rollout by the June 30 deadline. Commercial and rural banks and cooperatives would have an incentive to draw up lists as they would be paid money for loans which had suffered defaults. Official sources pointed out that most of the loans being targeted were anyway "basket cases' for the banks. With little hope of recovery, the banks should be more than willing to divert resources to identify farmers who can benefit from UPA's largesse. In this way, the government would not have to depend on land and revenue records, which were not always well maintained and could be open to manipulation as well. Though payment to the banks will be staggered, in the first year, the banks will be given Rs 40,000 crore. Agriculture minister Sharad Pawar told the media that in the next three years, the figure would be Rs 8,800 crore for 2008-09 and 2009-10 while the final amount to be paid in 2010-11 was expected to be Rs 2,400 crore. While the effectiveness of the loan waiver, and its potential political benefit, is being discussed, the Congress leadership is in an upbeat mood. Scenes of farmers celebrating and dancing have helped waiver enthusiasts argue that the Budget announcement was a popular hit. The massive giveaway, along with the pro-middle class decision to raise incometax exemption limits, could deliver a formidable advantage to the ruling combine. Those who feel somewhat differently point out that most of the really distressed farmers were engaged in dry-land farming. In normal circumstances, they were not eligible for high loan amounts and in contrast, farmers in irrigated areas, with holdings of similar size, would get larger loans. Dry-land farmers had to depend on private money lenders and these debts were outside the waiver. On the other hand, farmers in irrigated areas would now benefit from the waiver while also being in a position to raise regular loans from banks.

In its bid to woo the farming community, the Telugu Desam Party (TDP) is now planning to launch another programme across the State on the lines of Eruvaka. "The TDP has got an impressive response from the public, in particular, the farming community when our party leaders took out several road shows as part of the Eruvaka programme to enlighten farmers on the need for enhancing minimum support price (MSP) for paddy to Rs 1,000 per quintal. The party has now decided to launch similar programme with another name to raise agriculture-related issues further in the coming months across the State. And the whole objective is to exert pressure both on the Centre and State government to implement recommendations of M. S. Swaminathan Commission as well as Commission for Agriculture Costs and Prices (CACP) in toto and in particular, the MSP for paddy and wheat. Hence the party will launch a programme, whose name will soon be finalised,' TDP president N. Chandrababu Naidu told reporters on Wednesday. He was here to attend a marriage function of TDP senior leader Somireddy Chandramohan Reddy's daughter. Lack of clarity Claiming credit for the Centre's decision to waive farm loans, Mr. Naidu said that the Finance Minister would not have announced it, had TDP and UNPA not taken up the farmers' cause. "As a whole, the incentives announced in the Union budget are peripheral, while certain aspects lacked clarity. For instance, the definition of small and marginal farmers is a broad one. We want the Government to adopt a new definition as there is a different definition for marginal farmers in dry land, non-irrigated and irrigated lands.' When asked whether the TDP is still committed towards an integrated Andhra Pradesh, the TDP president ducked a direct reply by taking a dig at the Congress on separate statehood to Telangana. "Let the Congress first spell out its stance on the issue clearly. As the single point agenda of the Congress is to defeat TDP in elections, the party forged an alliance with Telangana Rashtra Samiti president K. Chandrashekhar Rao, who left the TDP on the separate statehood agenda after he was denied a ministerial berth. The ruling party had an understanding even with naxalites and cheated both of them along with its electoral partners CPI and CPI(M).

<p>Sorry for the long silence in the blog space. But I was fatigued and rather frustrated with the same old arguments and going-nowhere debates. So in the last few months we have been busy with new research to bring different perspectives to the old problems -- how will we share the increasingly scarce budget in an increasingly at-risk carbon constrained world.</p>

<p><strong><span style="font-size:14px;">Govt. gets its off shore wind policy right, but what about onshore wind power reforms ?</span></strong><br /> <br /> The <a href="http://www.indiaenvironmentportal.org.in/files/file/draft-national-policy-for-offshore-wind.pdf">Draft

<p align="center"><img alt="" src="http://www.indiaenvironmentportal.org.in/media/iep/homepage/mukul_blog.jpg" style="width: 600px; height: 117px; float: left;" /></p> <p><strong>Moving from emission

Tax reforms, which would penalise the unlimited use of nature, are fast becoming an imperative part of preparing national budgets, prodded by the realisation that ecological costs have to be accounted for, here and now. But will Manmohan Singh pay heed to

PRODUCING a newspaper or a newsmagazine is something like an unending string of little miracles. As technologists designing new machines well know, "if anything can go wrong, it will." The same

KRISHNA B Ghimire, who is a project coordinator with the UN Research Institute for Social Development in Geneva, has done extensive research on environment and sustainable development. Currently involved with intensive case studies in Brazil, central Amer